COVID 19 – Update 17th April Furlough Scheme

April 17, 2020

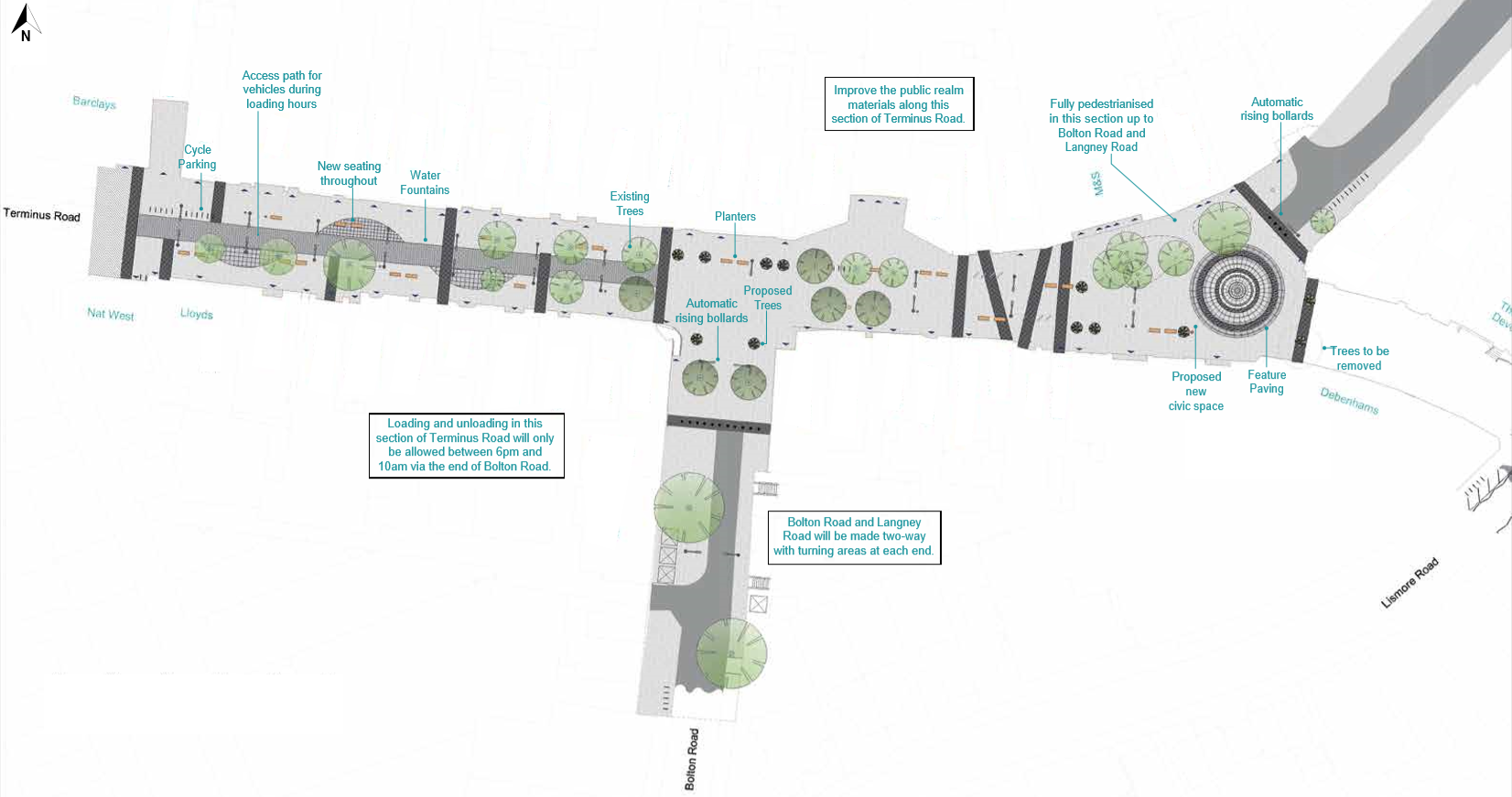

COVID 19: 21st April – Phase 2 Improvement Works

April 21, 2020Furlough Scheme

The online claim service for furloughed staff is now online here:

https://www.gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme

According to the BBC there were over 67,000 applications in the first thirty minutes of the portal going live.

We have had mixed reviews on the website – with some reporting that the site does crash. The Treasury says the system can process up to 450,000 applications an hour. Employers should receive the money within six working days of making an application.

Please do be patient if you can’t log in straight away.

HMRC Chief Executive Jim Harra told Today: “The big payroll date this month is on the 30th, so employers can claim anytime today, tomorrow or on Wednesday, and there’s time to get that money into their account for the 30th of April.”

To make a claim, you will need:

to be registered for PAYE online

your UK bank account number and sort code

your employer PAYE scheme reference number

the number of employees being furloughed

each employee’s National Insurance number

each employee’s payroll or employee number (optional)

the start date and end date of the claim

the full amount you’re claiming for including employer National Insurance contributions and employer minimum pension contributions

your phone number

contact name

You also need to provide either:

your name (or the employer’s name if you’re an agent)

your Corporation Tax unique taxpayer reference

your Self Assessment unique taxpayer reference

your company registration number

You should retain all records and calculations in respect of your claims. You can find more information on the scheme and eligibility to claim here.

The furlough scheme has been extended to cover June.

Small Business Grants

Businesses across the town are reporting that they have started to receive the payments of the small business grants. We understand that you should receive a remittance notice from Eastbourne Borough Council via email just prior to the money being deposited.

Please note – you have to apply for the grant from Eastbourne Borough Council. So, if you have yet to make a claim for your grant – please follow this link to access the portal: https://lewes-eastbourne.grantapproval.co.uk/

If you are having issues completing the application – please get in touch.

Dividend Payments

Minister for Small Business, Paul Scully, is working on a solution for the Self-Employed

Paul Scully MP, is trying to find a mechanism to support self-employed people working as a registered business. At the moment, people in this situation are not eligible for self-employment support and, although they could furlough themselves, would generally only receive £132.80 by doing so and would not be able to do any work.

If you would like to support his initiative, his twitter handle is @scullyp and his email address is [email protected]

If you are self employed and have not benefitted from a grant, send him details of your situation.

HMRC Time To Pay

HMRC has updated the information on it’s Coronavirus helpline for all businesses and self-employed people in financial distress that want to apply for support through HMRC’s Time To Pay service

https://www.gov.uk/government/organisations/hm-revenue-customs/contact/coronavirus-covid-19-helpline